Peter Buchignani, born September 21, 1986, is a finance executive at Amherst Pierpont Securities and the husband of Fox News anchor Carley Shimkus. The Princeton graduate and former defensive end built a successful career in securitized products sales while maintaining a remarkably private life despite his wife’s high-profile media career.

Peter Buchignani exists in an unusual space—married to one of Fox News’s most recognizable faces, yet deliberately unknown to most Americans. While his wife Carley Shimkus co-hosts Fox & Friends First each morning, Peter works in Chicago’s finance sector, specializing in securitized products sales at Amherst Pierpont Securities. He’s 39 years old as of 2025 and has spent over a decade building a reputation in investment banking, far from cameras and public attention.

His story matters because it challenges the typical “celebrity spouse” narrative. Peter didn’t abandon his career for his wife’s fame. He didn’t become a social media personality or leverage his connection for personal branding. Instead, he chose the harder path—maintaining professional excellence in a demanding industry while supporting a spouse whose job requires her to wake at 1 AM and appear on national television.

Born in Bloomington, Illinois, Peter grew up in a household that valued both achievement and discretion. His father, Leo Buchignani, practiced commercial real estate law after graduating from Harvard Law School. His mother, Mary Edna Buchignani, managed their home and raised Peter alongside his older brother Leo Jr. and younger sister Lainey.

The Buchignani household wasn’t flashy, but it was ambitious. Leo Sr.’s legal career in Memphis brought financial stability without excess. More importantly, it demonstrated that success doesn’t require publicity. This lesson clearly shaped Peter’s approach to his own life—build something meaningful, but don’t advertise it.

Peter’s high school years at University High School in Bloomington revealed an early pattern: excel quietly. He earned all-conference honors in football, maintained strong grades, and prepared for college without the self-promotion that defines many young athletes today.

From 2005 to 2009, Peter attended Princeton University, one of eight Ivy League institutions and consistently ranked among America’s top universities. He majored in political science, studying government systems, policy analysis, and international relations. The degree might seem disconnected from his eventual finance career, but political science graduates often excel in business—they understand how institutions function, how decisions get made, and how competing interests get balanced.

On the field, Peter played defensive end for the Princeton Tigers. The position requires reading offenses, reacting instantly, and performing under pressure—skills that translate directly to investment banking. In 2006 and 2007, he earned All-Ivy League Honorable Mention recognition. During the 2007 season, he started all 10 games and recorded 34 tackles, including 12 solo stops. His most productive game came against Yale with six tackles and one tackle for loss.

Princeton football doesn’t generate NFL prospects the way major programs do, but it develops discipline. Players balance demanding coursework with practice, travel, and competition. Peter’s ability to manage both prepared him for the 80-hour weeks that define entry-level investment banking.

After graduating in 2009, Peter faced the worst job market in decades. The 2008 financial crisis had devastated investment banks, eliminated thousands of positions, and made entry-level roles extraordinarily competitive. Landing anywhere in finance was an achievement. Landing at Barclays Capital was exceptional.

From July 2009 to August 2011, Peter worked as a sales analyst at Barclays Capital in New York City. The role introduced him to financial markets, client management, and the brutal pace of investment banking. Sales analysts typically work 12-14-hour days, analyzing market conditions, preparing presentations for senior bankers, and learning how institutional investors make decisions worth millions.

This period taught Peter two crucial lessons. First, finance rewards people who deliver results without needing recognition. Second, building client relationships matters more than individual transactions. These insights guided the rest of his career.

Peter’s next move took him to Deutsche Bank, where he worked in mortgage-backed securities (MBS) sales from January 2012 to January 2015. MBS trading became infamous during the 2008 crisis, but it remained a massive market for institutional investors. Banks that handled these securities well could generate significant revenue while managing risk properly.

Working in MBS sales required understanding complex financial instruments, regulatory requirements, and client needs simultaneously. Peter spent three years mastering these areas, building a track record that would eventually take him to Chicago.

In March 2015, Peter joined Amherst Pierpont Securities, a specialized investment firm focused on mortgage finance and securitization. Based in Chicago, he works in business development and securitized products sales—essentially helping institutional clients invest in mortgage-backed securities and related instruments.

Amherst Pierpont isn’t a household name, but it’s highly respected in mortgage finance circles. The firm employs experts who understand housing markets, mortgage lending, and the complex securities built from home loans. Peter’s role requires combining technical expertise with relationship management, explaining sophisticated products to sophisticated buyers.

His career trajectory shows steady advancement without dramatic leaps. He didn’t chase the highest salary or the most prestigious firm. Instead, he found a role that matched his skills and allowed him to build something lasting. Ten years at one firm is increasingly rare in finance, where professionals typically move every 2-3 years chasing promotions.

Peter and Carley’s relationship timeline remains slightly unclear, with different sources reporting different first meetings. Most accounts suggest they met around 2009 at a mutual friend’s gathering, possibly Carley’s 23rd birthday celebration on November 7. Both were young professionals in New York—Peter working in finance, Carley building her journalism career.

They didn’t date immediately. In fact, they remained friends for years before their relationship turned romantic around 2013. This slow development probably helped their eventual marriage. They knew each other as people before becoming a couple, understanding each other’s ambitions, working styles, and personalities.

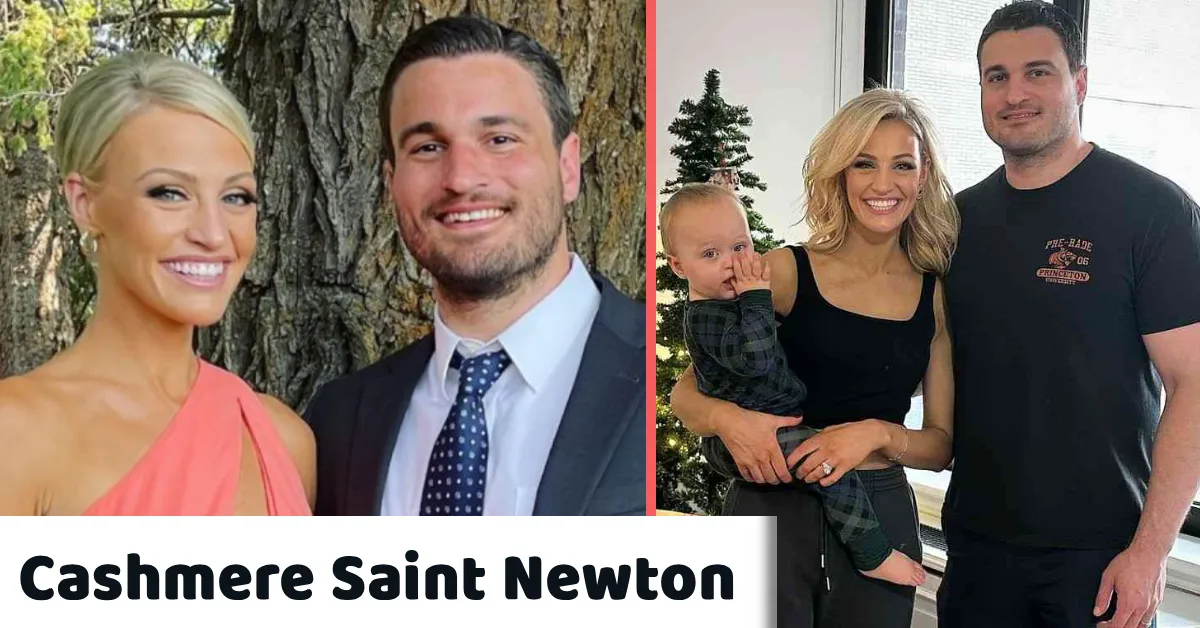

By 2015, they were engaged. On August 8, 2015, they married at Fiddler’s Elbow Country Club in Bedminster, New Jersey. The ceremony was private and attended by close family and friends. Notably, Peter was already working in Chicago by this point, meaning they planned their marriage knowing it would require managing distance.

Here’s what makes their relationship unusual: Carley lives in New York for her Fox News work. Peter lives in Chicago for his finance career. They’ve maintained this arrangement for nearly a decade.

Long-distance marriages typically fail. Research shows that couples living apart face higher stress, lower satisfaction, and greater infidelity risk than those living together. Yet Peter and Carley have made it work through deliberate choices.

First, they prioritize time together. When Carley has days off, she travels to Chicago. When Peter has flexibility, he flies to New York. Second, they maintain realistic expectations. Neither expected the other to abandon their career. Third, they communicate constantly—not just about logistics, but about their lives, challenges, and feelings.

Carley has spoken about their arrangement in interviews, noting that absence can strengthen relationships when both partners remain committed. Peter’s quieter approach means he rarely discusses their marriage publicly, but his consistent support speaks louder than interviews would.

In January 2023, Peter and Carley welcomed their son, Brock Edward Buchignani. The announcement came via Carley’s Instagram, where she shared a video from Fox News celebrating the birth. “Welcome to the world, sweet Brock,” she wrote. “You have unlocked a place in our hearts we didn’t even know we had.”

Brock’s arrival added new complexity to their already complicated logistics. Carley wakes at 1 AM for her morning show. Peter works full-time in Chicago. They’re now managing parenthood across two cities, which requires either one parent doing most childcare or constant travel.

Details about their parenting arrangement remain private, which is probably wise. Celebrity children face enough scrutiny without their parents sharing every detail. What’s clear is that both Peter and Carley are committed to being present parents despite their demanding careers.

Peter’s own upbringing likely influences his parenting. He grew up with a father who worked hard but remained present, a mother who provided stability, and siblings who stayed close. He understands that family matters more than career advancement, even while building a successful career himself.

Estimating Peter’s net worth requires more guesswork than precision. Most sources suggest between $500,000 and $1 million, though some estimates reach higher. These figures come from his career earnings, which likely include:

A Barclays Capital sales analyst probably earned $70,000-$90,000 annually in 2009-2011. Deutsche Bank MBS sales roles typically paid $100,000-$150,000 during his tenure. His current position at Amherst Pierpont Securities probably generates $150,000-$250,000 annually, depending on performance bonuses.

Over 15 years, aggressive saving and investing could easily produce $500,000-$1 million in net worth. His wife’s Fox News salary (reported around $56,000-$66,000 annually, though this seems low for a co-host) adds to their household income, though Carley’s net worth gets estimated separately.

More importantly, Peter doesn’t display wealth obviously. He’s not buying luxury cars, posting vacation photos, or building a personal brand. His financial success provides security and flexibility, not status.

Perhaps Peter’s most remarkable quality is his ability to remain essentially unknown while married to someone millions watch daily. He has no public social media presence. He rarely appears in photos or at events. When he does appear, it’s to support Carley, not to promote himself.

This choice is deliberate and increasingly rare. Most people married to celebrities eventually monetize their connection—through social media, business ventures, or media appearances. Peter has consistently refused this path, maintaining his finance career and private life despite easier options.

His privacy serves multiple purposes. First, it protects his professional reputation. Clients working with Amherst Pierpont Securities care about his financial expertise, not his famous wife. Second, it protects his marriage. Public relationships face unique pressures that private ones avoid. Third, it reflects his values. Peter grew up learning that meaningful work doesn’t require publicity.

This approach has worked. He’s built a successful career, maintained a strong marriage, and become a father—all while staying almost completely out of the public eye. In an era of constant self-promotion, his restraint is remarkable.

Peter Buchignani’s story challenges easy categorization. He’s not a “celebrity spouse” who abandoned his identity for his partner’s fame. He’s not a failed professional living off his wife’s success. He’s a finance executive who happens to be married to someone famous, maintaining his own career and identity despite opportunities to do otherwise.

His life offers a different model for relationships where one partner is famous and the other isn’t. Rather than competing for attention or abandoning his own ambitions, Peter has carved out a separate space where he can excel on his own terms. He supports Carley’s career without making it his career. He participates in her public life when helpful, without becoming a public figure himself.

That balance requires unusual discipline and self-awareness. It also requires a partner who respects that choice, which Carley clearly does. Their marriage works because both value the other’s independence as much as their connection.

Whether this model works for everyone is debatable. But for Peter Buchignani, it’s enabled him to build exactly the life he seems to want—professionally successful, privately fulfilled, and deliberately unknown to most people reading about him.